In the tech era, it’s no surprise that payment services have moved online. With a few clicks of a button, you can now send money to friends and family across the globe at lightning speed. But did you know that there are more intricacies behind online payment methods than just convenience? From security protocols to emerging trends in cryptocurrency, understanding how these payments work will help your business stay ahead of the curve.

In this blog post, we’ll discuss six essential facts about payment services in the tech era – so get ready to gain an insight into this ever-evolving world!

The Link Between Merchants and Payment Service Providers

If you’re a merchant looking to offer online payment options for your customers, you probably have come across the terms “PSD” and “PSD agents.” PSD stands for Payment Services Directive, which is a set of regulations set by the European Union aimed at creating a unified payments market.

PSD agents are companies or individuals that act as intermediaries between merchants and payment service providers. A psd agent helps merchants navigate the complex world of online payments by providing services such as payment processing, fraud detection, and compliance with regulations. By working with a PSD agent, merchants can focus on running their business while leaving the technical aspects of online payments to the experts.

Going Cashless and Choosing Digital Payment

Convenience reigns supreme. And when it comes to making payments, going cashless and choosing digital payment solutions are the way to go. One major advantage of digital payments is that they are quick and efficient, eliminating the need to rummage through wallets, count change, or stand in long lines. Additionally, these payment options are safe, secure, and reliable, allowing for peace of mind when it comes to protecting our hard-earned money.

Plus, going cashless can also help track spending more accurately, preventing overspending and allowing for better money management. With the availability of digital payment options everywhere we go, there’s no reason not to take advantage of the many benefits they offer.

Types of Payment Services Available

Payment services have become an integral part of our daily transactions. Gone are the days of carrying cash or writing checks. With the advancement of technology, we now have access to various payment services that have made our lives much easier. From traditional payment options such as credit cards and debit cards to new-age payment methods such as mobile wallets and cryptocurrency, the choices seem endless.

Each option has its pros and cons, and it ultimately comes down to personal preference and convenience. With so many payment services available today, there is certainly no shortage of options to explore and find the perfect fit for your needs.

Evaluate a Payment Service’s Security and Privacy Protocols

Online transactions are a part of our daily lives, and with the convenience of making payments comes the responsibility of ensuring that our financial information remains protected. Evaluating the security and privacy protocols of a payment service is crucial to prevent any unauthorized access to sensitive data. One should look for payment services that utilize encryption technology such as SSL or TLS, which scrambles data during transmission, making it unreadable to anyone attempting to intercept it.

Additionally, payment services should have a two-factor authentication process in place to ensure that only the authorized user has access to their account. It is also important to read the provider’s privacy policy carefully to ensure that the customer’s private data is not being shared with third parties for marketing purposes. By taking these steps, one can make informed decisions when it comes to selecting a payment service with secure and private protocols.

Mobile Payments Over Traditional Bank Transactions

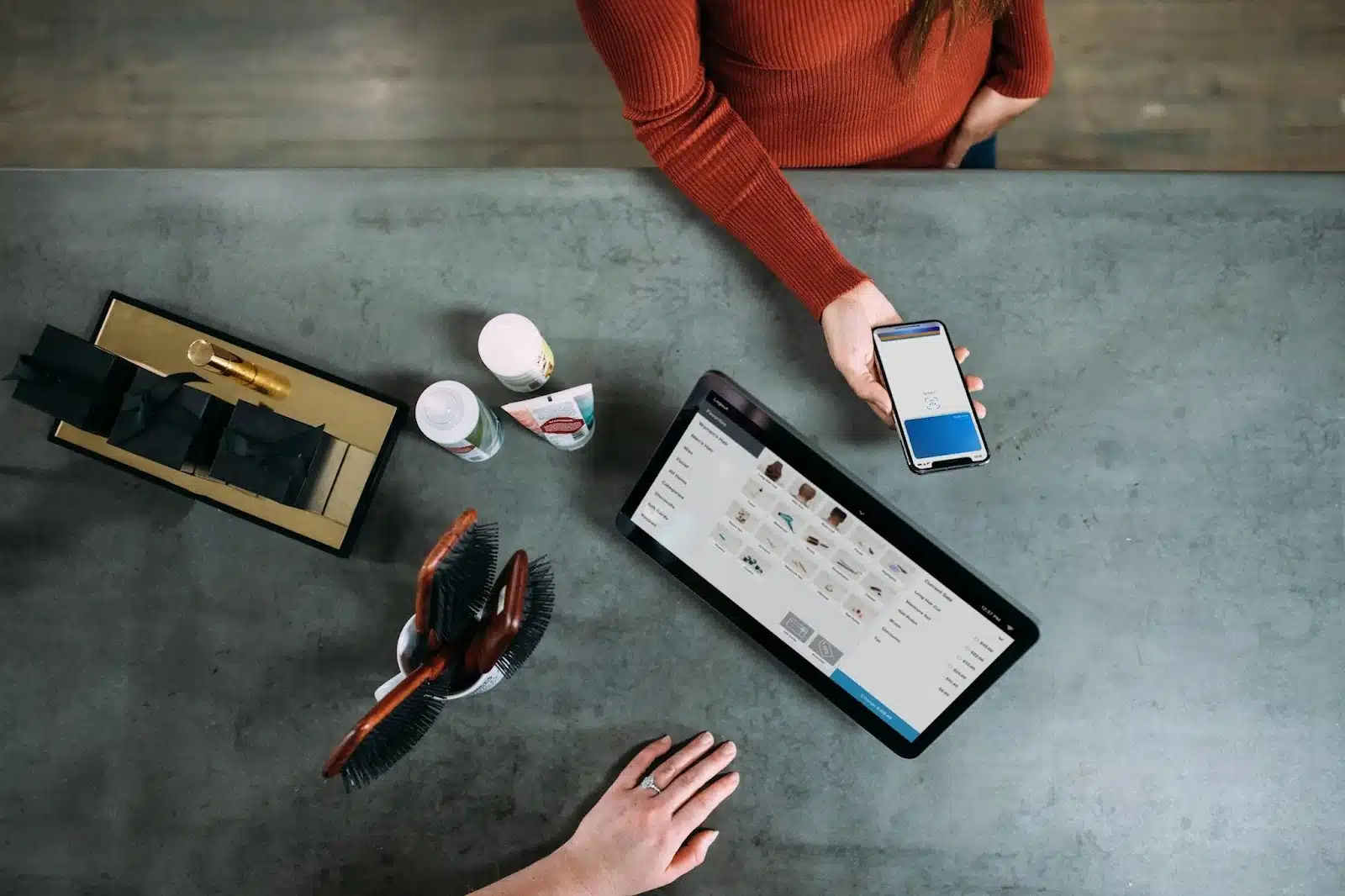

Mobile payments are revolutionizing the way we conduct financial transactions, offering a faster, more convenient, and more secure alternative to traditional bank payments. Unlike traditional payments, mobile payments can be made in just a few seconds, without the need for cash or credit cards. This makes mobile payments particularly useful for those who are always on the go and don’t want to carry around bulky wallets or risk losing their payment cards.

Moreover, mobile payments are often more secure than traditional payments since they use complex encryption technologies to protect your financial information from hackers and other unauthorized users. With mobile payments, you can also keep track of your transactions in real-time, making it easier to budget and manage your finances. All in all, there are many advantages to mobile payments, making them an increasingly popular choice for consumers around the world.

What are the Repercussions?

Using a third-party payment provider can have its advantages, but it also comes with potential repercussions. One significant risk is a breach in security, which can compromise sensitive data such as credit card information. In addition, relying on a third party for payment processing can create a significant dependency, and if something goes wrong with the provider, it can disrupt your business operations.

Another downfall is the lack of control over payment processes, as the third party may not have the flexibility to handle unique situations or needs. Therefore, it’s crucial to thoroughly research and assess the performance and security of any third-party payment provider before partnering with them. Overall, utilizing a third-party payment provider can be beneficial but requires careful consideration and management to avoid negative impacts.

There is no denying the importance and advantages of utilizing digital payment solutions for both businesses and consumers. While these tips may help guide you through the process of selecting a suitable payment provider, ultimately it is up to you to make an informed decision about what works best for you or your business.

Lucas Noah, armed with a Bachelor’s degree in Information & Technology, stands as a prominent figure in the realm of tech journalism. Currently holding the position of Senior Admin, Lucas contributes his expertise to two esteemed companies: OceanaExpress LLC and CreativeOutrank LLC. His... Read more