Cryptocurrency exchanges are a key part of the cryptocurrency ecosystem. They provide an easy way for you to buy and sell cryptocurrencies, and they also offer a wide range of other services that make crypto trading easier, faster, and more secure than ever before.

Although there are many different types of crypto exchanges out there, they all fall into one of two categories: centralized or decentralized. But what exactly do those categories mean? Let’s find out!

Defining Exchange Models: A Clear Distinction

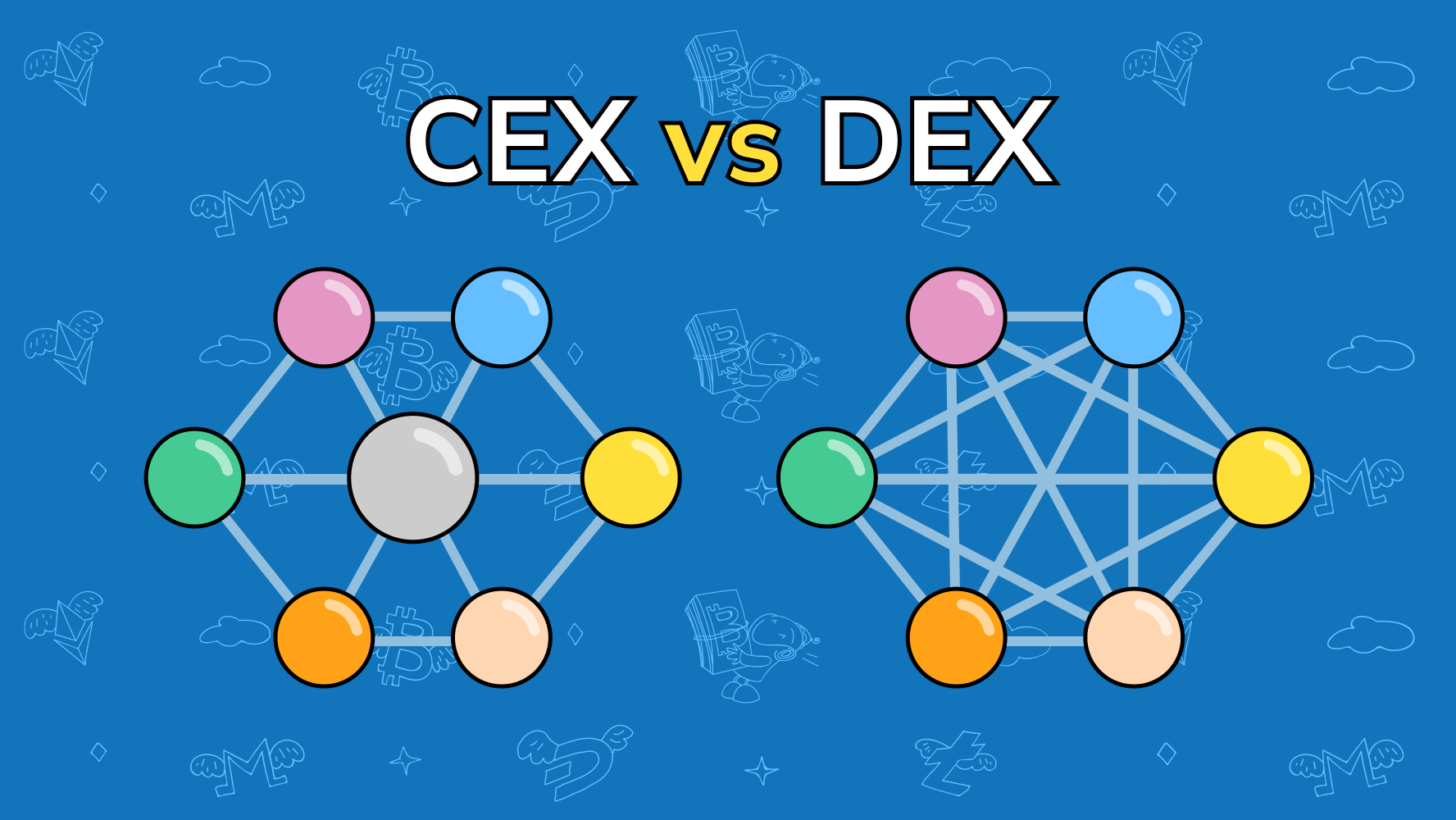

Centralized and decentralized exchanges are different in that they have a central authority or not. The former is controlled by a single entity, while the latter has no single point of failure.

Decentralized exchanges (DEXs) have their data stored on distributed ledgers and are therefore more transparent than their centralized counterparts, which store their users’ funds on servers controlled by an organization or individual.

User Experience: Centralized Exchange Dynamics

You’ll notice that the user experience is a key differentiating factor between centralized and decentralized exchanges. Centralized exchanges are easier to use, more convenient, and have more liquidity than their decentralized counterparts. In addition to these advantages, they also offer more features and security measures, which makes them attractive for beginners and experienced crypto traders alike to convert wbtc to btc or other cryptocurrencies on such exchanges.

As you can see from this section on user experience dynamics the first of three sections in this guide centralized exchanges are generally considered superior when it comes to providing an intuitive interface for novice traders who may not know much about cryptocurrencies or how they work; however, some key drawbacks come along with using a centralized platform (which we’ll discuss later).

Decentralized Exchanges: Empowering Users

Decentralized exchanges will make it more difficult to exchange wbtc to matic or perform any other transaction, but they are also much safer, faster, and cheaper.

Decentralized exchanges empower users by allowing them to retain control over their coins at all times. This means that you don’t need to rely on an intermediary that could potentially lose your funds or steal them outright you hold your own private keys (the secret strings of numbers used to identify cryptocurrency addresses). This makes it impossible for hackers or scammers to run off with your money because there is no central point of weakness in the system; if someone else gets their hands on one of your private keys, it doesn’t mean anything unless they also have access to all other wallets using that same key pair (which isn’t likely). Decentralized exchanges have no single point of failure either they use peer-to-peer protocols which means there’s no central server where hackers can attack from outside like they would if trying to break into an exchange like Binance or Kraken (both examples from earlier).

A Glimpse Ahead: Centralized and Decentralized Exchanges in the Future

As you can see, both centralized and decentralized exchanges have their pros and cons. Centralized exchanges are here to stay; they have a long history, are well-known by crypto enthusiasts around the world, and have a large user base. However, as we’ve seen above when discussing regulatory issues, centralized exchanges will need to adapt their business models to comply with regulations that make them more secure but also less appealing for many users (for example those who value privacy).

Decentralized exchanges will continue growing but at a much slower pace than before because they lack liquidity compared with their centralized counterparts. In addition, they also need more time for adoption since most people aren’t familiar with how these platforms work yet; however, this doesn’t mean that such platforms won’t succeed in attracting new users over time!

Conclusion

We hope this article has helped you better understand the differences between centralized and decentralized exchanges. As we mentioned earlier, these two models pose very different user experiences and have varying degrees of security. While centralized exchanges offer high liquidity, they are not as secure as decentralized ones since they rely on single points of failure. Decentralized exchanges allow users to retain control over their funds but don’t necessarily provide the same level of liquidity or convenience found in centralized platforms

Lucas Noah, armed with a Bachelor’s degree in Information & Technology, stands as a prominent figure in the realm of tech journalism. Currently holding the position of Senior Admin, Lucas contributes his expertise to two esteemed companies: OceanaExpress LLC and CreativeOutrank LLC. His... Read more